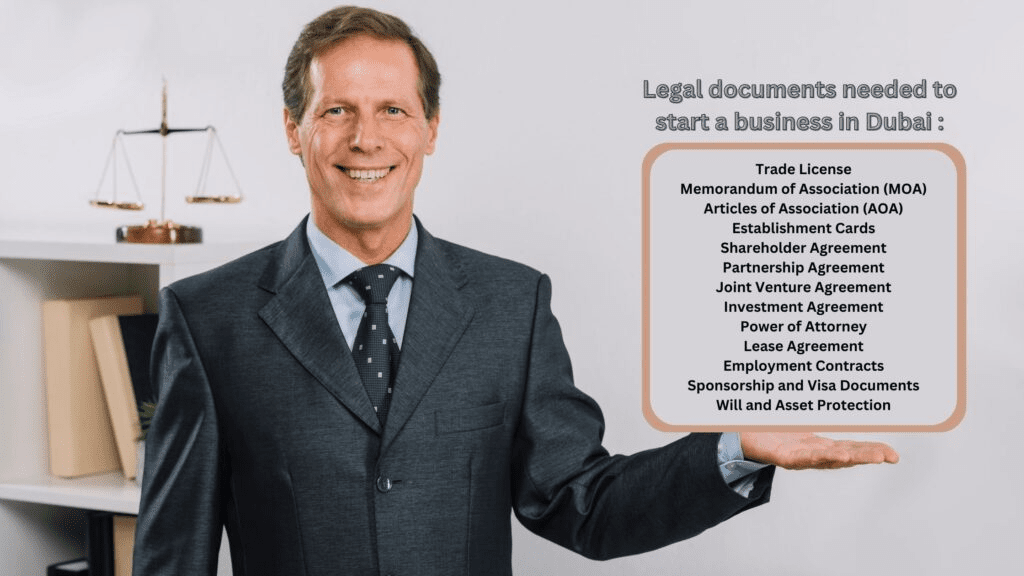

Legal documents needed to start a business in Dubai

Starting a business in Dubai can be an exciting endeavor, but it’s crucial to understand the legal requirements and necessary documentation to ensure a smooth and compliant establishment. Properly drafted legal documents protect the rights and interests of all parties involved and mitigate potential risks. In this article, we will explore the essential legal documents you need to consider when starting a business in Dubai.

Essential Legal Documents Needed to Start a Business in Dubai are :

Trade License:

Obtaining a trade license is a fundamental requirement for starting a business in Dubai. The type of license you need depends on the nature of your business activity. Three primary categories of licenses exist, namely commercial, professional, and industrial licenses. Commercial licenses cover trading activities, professional licenses are for service-based businesses, and industrial licenses are necessary for manufacturing or industrial activities.

Memorandum of Association (MOA):

The Memorandum of Association is a foundational document that outlines the company’s structure, objectives, and shareholders’ roles and responsibilities. It includes details such as the company’s name, address, share capital, and the distribution of shares among shareholders. The MOA must be notarized and submitted to the Department of Economic Development (DED).

Articles of Association (AOA):

The Articles of Association complement the MOA and provide more detailed information about the internal management and regulations of the company. It includes provisions related to the appointment and powers of directors, shareholder meetings, profit distribution, and decision-making processes.

Establishment Cards:

Establishment cards are required for businesses in Dubai to ensure compliance with labor laws and regulations. These cards serve as identification documents for the company and its employees and are issued by the Ministry of Human Resources and Emiratisation (MOHRE). The establishment card includes information such as the company’s name, license number, and authorized signatories. It is necessary for various purposes, including visa processing, labor contracts, and government transactions.

Shareholder Agreement:

A shareholder agreement is a legally binding contract among the company’s shareholders. It covers matters that may not be addressed in the MOA or AOA, such as the transfer of shares, dividend policies, dispute resolution mechanisms, and decision-making processes. This agreement helps ensure transparency and harmonious relations among shareholders.

Partnership Agreement:

If you plan to start a business in partnership with others, a partnership agreement is crucial. It outlines the rights, obligations, profit sharing, and decision-making processes among partners. This agreement should address aspects like capital contributions, management responsibilities, dispute resolution, and the process for admitting or removing partners.

Joint Venture Agreement:

In cases where two or more entities collaborate to establish a business, a joint venture agreement is necessary. This agreement outlines the terms, obligations, and profit-sharing arrangements between the joint venture partners. It addresses key aspects such as the purpose of the venture, contributions of each party, management structure, and dispute resolution mechanisms.

Investment Agreement:

If you are seeking external investment for your business, an investment agreement is vital. This agreement specifies the terms and conditions of the investment, including the amount invested, ownership percentage, voting rights, dividend preferences, exit strategies, and other relevant provisions. It ensures clarity and protects the interests of both the investor and the business owner.

Power of Attorney:

A power of attorney grants authority to another person or entity to act on your behalf. In the context of starting a business in Dubai, it may be necessary to appoint a local representative or agent. This document enables the appointed individual to perform legal and administrative tasks, such as signing contracts, making business decisions, or dealing with government authorities on your behalf.

Lease Agreement:

To establish a physical presence for your business, you will need to lease commercial premises in Dubai. A lease agreement is a legal contract between the tenant and the landlord, specifying the terms of rent, duration, renewal options, and other conditions. It is important to ensure that the lease agreement is in compliance with local laws and regulations.

Employment Contracts:

If you plan to hire employees in Dubai, you must have legally compliant employment contracts. These contracts should clearly define the terms of employment, including job roles, responsibilities, compensation, working hours, leave policies, and termination clauses. Adhering to the UAE Labor Law is essential to protect the rights of both employers and employees.

Sponsorship and Visa Documents:

Foreign business owners or employees must obtain the necessary sponsorship and visa documents to work and reside in Dubai. These documents include a valid passport, entry visa, Emirates ID card, and residency visa. The specific requirements and procedures for obtaining these documents can vary depending on the business structure and the individual’s nationality.

Will and Asset Protection:

While not a mandatory document for starting a business in Dubai, a will and asset protection strategy is highly recommended, especially for foreign business owners. A will is a legal document that specifies how your assets and business interests should be distributed in the event of your demise. It ensures that your business and personal assets are transferred to your chosen beneficiaries according to your wishes, mitigating potential disputes and ensuring a smooth transition.

Knowledge Base

How to choose the best company Structure when setting up a business in Dubai?

Sole Proprietorship:

A sole proprietorship in Dubai is a business structure characterized by single ownership and operation, making it the most basic and uncomplicated form of business entity.

Pros:

- Easy and cost-effective setup process.

- Complete control and decision-making authority.

- Direct and simple taxation system.

- No requirement for a minimum capital investment.

Cons:

- Unlimited personal liability, meaning the owner’s personal assets are at risk in case of business debts or legal issues.

- Limited ability to raise capital as it relies solely on the owner’s resources.

- Limited growth potential due to the absence of separate legal entity status.

Documents Required for Sole Proprietorship Company Setup in Dubai:

- Copy of the owner’s passport and visa.

- Trade name reservation certificate.

- Application form for business registration.

- No objection certificate.

- Initial approval from DED.

- Leasing agreement for the business premises.

Limited Liability Company (LLC):

An LLC is a popular choice for business setup in Dubai, allowing for a partnership between local and foreign investors.

Pros:

- Limited liability, wherein the personal assets of the owners are protected.

- Flexibility in profit sharing among partners.

- Ability to engage in various business activities.

- Greater credibility and market reputation compared to a sole proprietorship.

- Potential to attract external investors.

Cons:

- Higher setup and maintenance costs compared to a sole proprietorship.

- The requirement is to have a local UAE national or company as a sponsor or partner with a minimum of 51% ownership.

- More complex legal and administrative procedures.

- Limited control for foreign investors due to majority ownership by local partners.

Documents Required for LLC company setup in Dubai :

- Copy of the partners’ passports and visas.

- Memorandum of Association (MOA).

- Articles of Association (AOA).

- Local service agent agreement.

- Trade name reservation certificate.

- Initial approval from the DED.

- Leasing agreement for the business premises.

Corporation:

A corporation, also known as a joint stock company, is suitable for large-scale business operations and investment opportunities in Dubai.

Pros:

- Separate legal entity status, offering limited liability to shareholders.

- The capacity to issue shares and secure funds via public offerings..

- Enhanced credibility and attractiveness to investors.

- An effective governance framework characterized by well-defined roles and responsibilities

- Potential for expansion and growth through mergers and acquisitions.

Cons:

- More complex setup and compliance requirements.

- Higher initial capital investment compared to other structures.

- More stringent reporting and disclosure obligations.

- Extensive documentation and legal formalities.

- Potential for conflicts among shareholders and management.

Documents Required for Corporation company setup in Dubai:

- Copy of shareholders’ passports and visas.

- Memorandum of Association & Articles of Association.

- Board resolutions and power of attorney documents.

- Trade name reservation certificate.

- Initial approval from the DED.

- Leasing agreement for the business premises.

Choosing the right business structure in Dubai depends on various factors, including the nature of your business, liability concerns, investment requirements, and growth aspirations. A sole proprietorship offers simplicity but carries unlimited personal liability. LLCs provide a balance between ownership control and limited liability, while corporations offer more growth opportunities but entail greater complexities. Consulting with business advisors or legal professionals like us is recommended to make an informed decision based on your specific needs and goals.

How does Legal House Assist you?

At Legal House, we are committed to providing exceptional legal services to businesses in Dubai. With our expertise, attention to detail, and dedication to client satisfaction, we aim to be your trusted legal partner. Whether you are a startup, SME, or large corporation, we offer tailored solutions to meet your unique business requirements.

Contact us today to schedule a consultation and discover how Legal House can assist you in reviewing commercial contracts, guiding you through the legal aspects of your business, and providing comprehensive legal support. Empower your business with sound legal advice and protect your interests with Legal House.

FAQ

The legal documents, such as the MOA and AOA, need to be notarized by a notary public in Dubai

Some industries or activities may have specific requirements. For example, healthcare businesses may require additional approvals from relevant authorities. Contact us for detailed information.