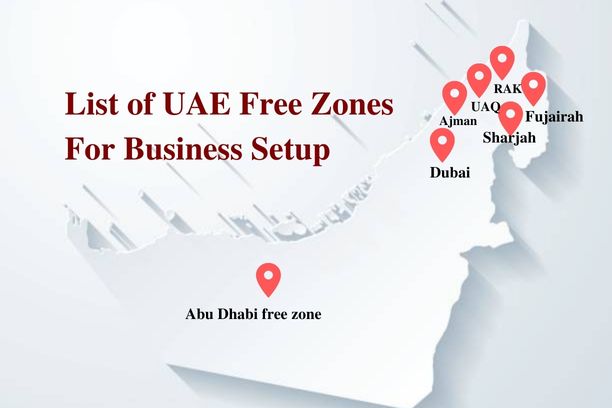

List of UAE Free Zones For Business Setup

The UAE Free Zones are an excellent place for starting your business. It offers corporate, tax and operational advantages not just for the residents of the UAE but also companies around other countries. The country has a rich history and culture. It is one of the oldest civilizations in the world and has been inhabited for over 5,000 years. The country was also an important trade route between East and West during ancient times. Today, Dubai has evolved into one of the most exciting cities in the world with its modern architecture and high-tech infrastructure. In fact, it has been called ‘the city of dreams’ by many because of its luxurious lifestyle and other attractions. Dubai is also one of the fastest-growing economies in the world due to its strategic location at the crossroads between Asia and Europe. This makes it very attractive for investors who want to start their businesses here.

However, there are certain rules that need to be followed while setting up a company in Dubai or any other emirate in UAE. In this article, we will discuss some of these regulations so that you know what you should expect when starting a business in the UAE, the list of UAE free zones, and their benefits.

List of UAE free zones for company formation:

The UAE has an interesting mix of free zones and special economic zones that facilitate business operations. The list below provides an overview of the different free zones in the country:

List of UAE free zones in Dubai:

1. International Free Zone Authority -IFZA

2. Dubai Gold and Diamond Park

3. Dubai Media City

4. Dubai Multi Commodities Centre

5. Dubai Flower Center

6. Dubai Textile Village

7. Dubai Internet City (DIC)

8. Dubai Knowledge Village

9. Dubai Technology and Media Free Zone

10. Jumeirah Lakes Towers Free Zone –JLT

11. Dubai South Free Zone

12. Dubai Production City

13. Meydan Free zone

14. Dubai Airport Free Zone DAFZ

15. Dubai Auto ZZone

16. Dubai Biotechnology & Research Park

17. Dubai Techno ParkInternational Media Production Zone

18. International Humanitarian City

19. Dubai Healthcare City

20. Dubai Outsource Zone

21. Dubai International Academic City

22. Dubai Car and Automotive City Free Zone -DUCAMZ

23. Dubai Design DistrictDubai Industrial City -DIC

24. Dubai International Financial CentreDubai Silicon Oasis

25. Dubai Science Park

26. Dubai Logistics City

27. Jebel Ali Free Zone Dubai

Abu Dhabi UAE free zone:

1. Abu Dhabi Airport Free Zone -ADAFZ

2. Industrial City of Abu Dhabi

3. Masdar City Free Zone

4. twofour54

5. Higher Corp for Specialized Economic Zones

6. Abu Dhabi Global Market

7. Khalifa Industrial Zone

Sharjah free zones:

1. U.S.A. Regional Trade Center Free Zone

2. Sharjah Publishing City Free Zone

3. Sharjah Airport International Free Zone -saif

4. Sharjah Publishing City Free Zone (SPC Free Zone)

6. Hamriyah Free Zone Sharjah

7. Sharjah Media City Free Zone (Shams)

Ajman UAE Free zone:

1. Ajman free zone and other one is Ajman media city free zone

UAQ UAE free zone:

Umm al Quwain free trade zone

Fujairah UAE free zone:

1. Fujairah free zone & other one is Fujairah creative city

RAK UAE free zone:

1. Ras Al Khaimah Economic Zone

2. Ras Al Khaimah Investment Authority

3. Ras Al Khaimah Media Free Zone

4. Ras Al Khaimah Free Trade Zone

5. RAK Maritime City Free Zone Authority

Advantages of setting up business in Dubai Free Zone :

The main advantage of setting up a business in a free zone is that there are no restrictions on hiring local or foreign employees or importing goods and services into the country. This means that companies can operate with greater flexibility than if they were based outside of a free zone.

Tax-free environment: Tax-free environment No corporate tax or income tax on profits from your business. You can also enjoy 100% foreign ownership without any restrictions on the repatriation of capital or profits.

Relaxed visa regulations: You can hire foreign professionals and get visas for them easily with no restriction on their stay period in UAE. Free zone companies can sponsor work permit applications for individuals who wish to relocate permanently to UAE, or those who require short-term business trips into the country.

Financial freedom: 100% foreign ownership allows you to raise capital easily from anywhere in the world, as well as access local banks for funding requirements like trade finance facilities, receivables financing, or other banking services that are not available outside free zones.

Ease of business registration.

No government approval is required for foreign ownership or employment.

Businesses can operate outside of the country’s restrictive labor laws and tax regime.

How Legal House helps you in UAE free zone business formation:

We can help you set up your Free Zone business in Dubai, UAE. We are a team of experts in Free Zone consultancy and we help our clients to get their business licenses in the best free zones of Dubai, UAE. Our services are designed to help you start your business in Dubai or any other Emirate of UAE without any hassle. We offer complete package solutions for new companies looking to register in Dubai or any other emirate of UAE by providing full support from day one to ensure that there is no delay on your part during the registration process.

We provide a complete range of services including:

Free Zone Company Formation

Consultancy Services

Business Registration in Free Zones

General Trading License issuance

Contract drafting & review Visa assistance. Get in touch with us at +971 555683294, Email us at info@legal-house.com.

І think the admin of this website is actuallү working hard

in support of his websitе, since here every data is quality based data.

Pingback: How to open a consulting firm in Dubai? - Legal house Dubai

Pingback: Jumeirah Lake Towers Free Zone Company Formation-JLT - Legal house Dubai

Pingback: How to set up a shipping company in Dubai: Logistics License?

Pingback: How to Obtain a Building Materials Trading License in Dubai?

Pingback: How to open a consulting firm in Dubai? - Legal-House